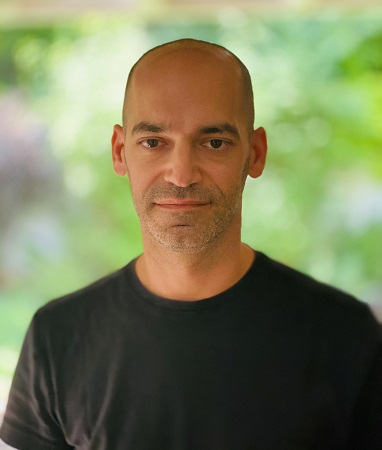

Jeff Ma

Venture Advisor

As a member of the infamous MIT Blackjack Team, Jeff Ma created an ingenious method for counting cards—using talent, creativity, math, and teamwork to win millions in Las Vegas. Ma was the inspiration for the best-selling book Bringing Down the House and the hit movie, 21. He is also an accomplished entrepreneur having started four different companies including GolfSpan (sold to Demand Media), CircleLending (sold to Virgin), Citizen Sports (sold to Yahoo) and tenXer (sold to Twitter).

Beyond his work as an entrepreneur, Ma has been at the forefront of the “Moneyball” movement working with professional sports teams like the San Francisco 49ers and the Portland Trail Blazers and media powerhouses like ESPN and Major League Baseball Advanced Media, helping them to make better decisions using data and analytics. His business bestselling book, “The House Advantage: Playing the Odds to Win Big in Business” draws on his unique experiences at the table and in the sports world to create a truly accessible book about analytics.

Ma has also held two executive roles, serving as VP of Data Science and Analytics at Twitter and as Microsoft’s Vice President of Startups. Currently, Ma is the Chief Digital Officer of Troon where he leads an ambitious effort to revolutionize golf with technology and data.

Recent Comments